This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. I appreciate you addressing this at your earliest convenience so we can work out this matter. If you have any questions or concerns, or would like to discuss payment plan options, please contact me at. If your payment has already been sent, please disregard this notice. Please let me know the status of your payment. The outstanding invoice amount is and is past due.

As your invoice is now past due, a late fee of has been assessed. Our records show that we have not yet received payment for invoice #XXXXX in the amount of, which was due on. This email is to remind you that your invoice is now 30 days past due and I am seeking your immediate attention. Subject line: : Invoice #XXXXX for is 30 days PAST DUE Here is a 30-day past due invoice email template that you can simply copy, paste, edit and send to your customer: Politely let your client know via email that you will have to stop working on current projects until the bills are current. If you are dealing with the accounting department, it might be time to get your client involved again as they have a vested interest in seeing you get paid in a timely fashion so the work can go on.Īnd that’s because this is an ideal time frame to cease current and future work. Be clear that you need to be paid and make sure you’re talking to the right person. However, it’s perfectly fine to state your terms for late payments right up front and then be sure to itemize them on the next bill.Īt this point, you may want to dial up your persistence. Hitting a customer with an unexpected late fee could cause more animosity than it’s worth. You can also begin assessing late payment fees -but this is important-only if you had first explained it in your new client onboarding. In addition to email, send it via snail mail, which might get their attention. If you have already spoken with the client, resend the invoice, along with any new charges, and reference the conversation you had and any concrete plans they had stated to send payment.

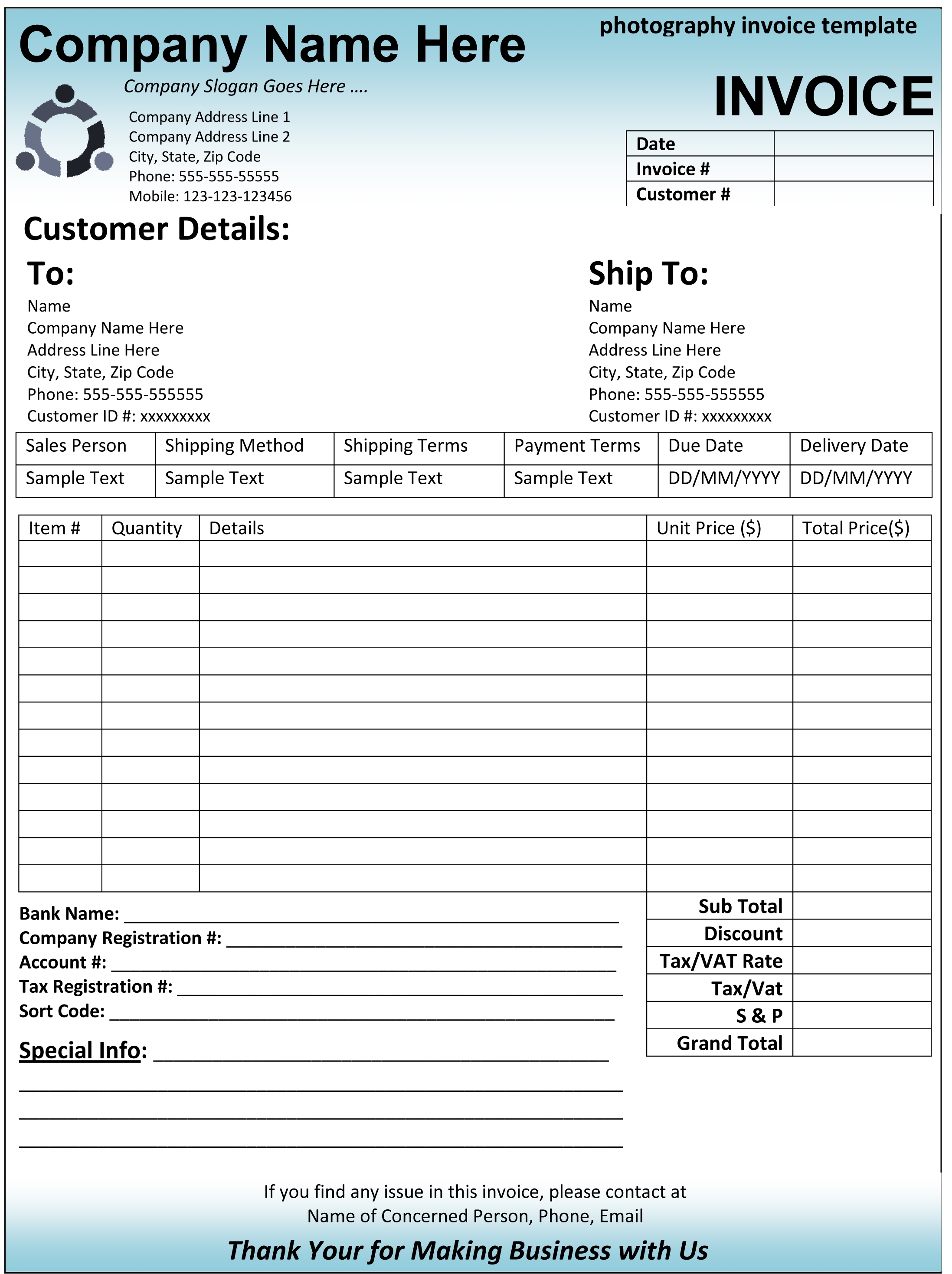

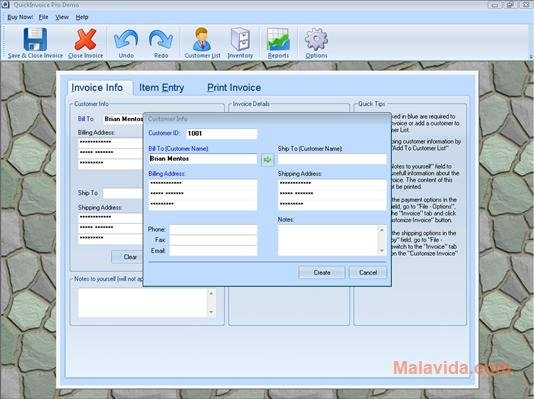

Make a quick invoice professional#

Keep calm and stay professional in your follow up. Sending a reminder that their payment is due next week gives them a heads up, and may get the money you’re owed in your hands more quickly.Ī payment this late may feel like it is bordering on rude, but that doesn’t mean you should be. The most common payment term is “Net 30,” which means the recipient must pay their invoice within 30 days of the invoice date.īe proactive and remind customers of their outstanding payments. Adding a date gives them a concrete target to meet. You may be tempted to put “immediate payment,” but that can be confusing to some clients. Without clear payment terms, it’s your word against theirs when an invoice is actually “late.” You should also check that your payment terms and due date are featured in a prominent place on your invoice design. If you haven’t yet cataloged your products or services, it’s a worthwhile exercise that can make everything from marketing your business to sending invoices more efficient in the future.

Who should get the invoice: Sometimes it’s the client themselves, sometimes it’s the accounting department, or both.There’s always next time.īut it can be easier to get payment if you’ve determined these two specific logistics of what your client wants and needs in an invoice: If it’s too late for that, don’t beat yourself up. Agree to a preferred invoice payment method up-frontįor faster payments, hold the invoice conversation right at the start, before you do the work.

0 kommentar(er)

0 kommentar(er)